Submit Change to Structural Variable: Difference between revisions

| Line 38: | Line 38: | ||

This will open all NFIP structural variable fields for editing. | This will open all NFIP structural variable fields for editing. | ||

{{Box task | {{Box task | ||

|image = Img-proc-change- | |image = Img-proc-change-strvar-fields.png | ||

|size = 400px | |size = 400px | ||

|caption = Make adjustments to the coverage and deductibles as appropriate. | |caption = Make adjustments to the coverage and deductibles as appropriate. | ||

Revision as of 07:59, 12 March 2025

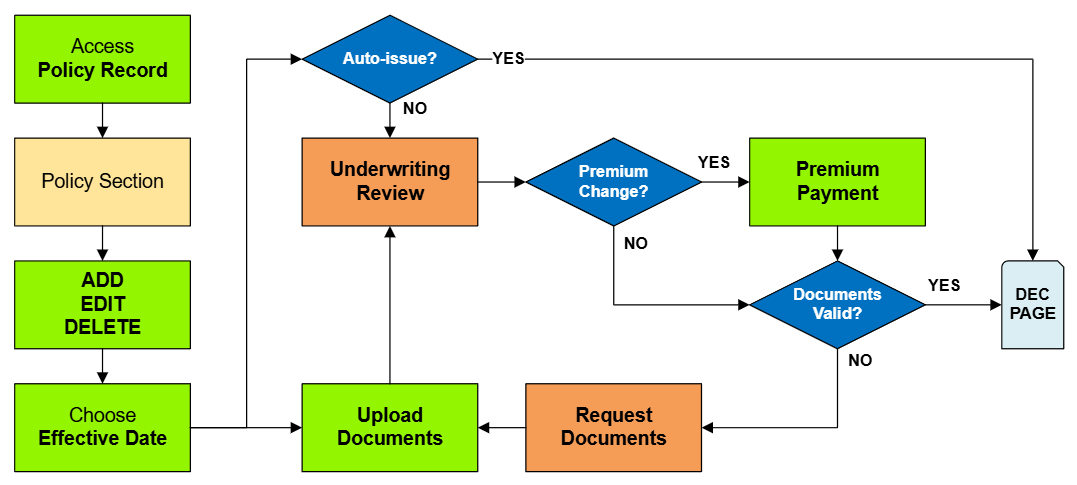

This procedure explains how agents can submit requests to change or correct the building details on an NFIP policy. Most structural variables determine policy rating, so premium may be impacted. Supporting documentation may be required.

|

Procedural Steps

1. Access Policy Record

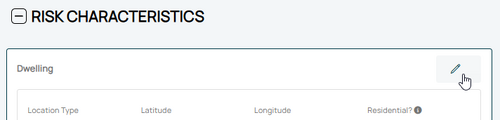

Scroll down to the "Risk Characteristics" section manually.

2. Edit Risk Characteristics

This will open all NFIP structural variable fields for editing.

Changes to coverage must follow NFIP guidelines for Effective Date calculation and documentation.

Coverage Change Rules

Required Documentation: Premium Payment

When coverage is reduced to zero, the corresponding deductible must be set to zero.

Coverage decreases can be made on upcoming renewals without the requirements needed for policy changes. [1]

Required Documentation: Building coverage: proof the building is over-insured, either through error or removal. [2]

Required Documentation: Duplicate RCBAP coverage: copy of the RCBAP declarations page.

Required Documentation: Contents coverage: proof the property was sold or removed. [3]

Required Documentation: Policyholder's signature [4]

Required Documentation: A lender's letter that requires a lower deductible [7]

Required Documentation: Premium Payment

In general, increases and decreases are typically done in separate transactions with separate payments, but they can be combined.

| Coverage Increase | Coverage Decrease | |

| Deductible Increase | 30-day Wait + No Wait Separate or Combined | No Wait (both) Separate or Combined Cannot backdate deductibles |

| Deductible Decrease | 30-day Wait (both) Combined | No Wait + 30-day Wait Separate Only |

- Coverage Increase + Deductible Increase: The deductible increase can coincide with the coverage increase, or it can be done separately

- Coverage Increase + Deductible Decrease: The deductible decrease can coincide with the coverage increase (same rules apply)

- Coverage Decrease + Deductible Increase: The deductible increase can coincide with a mid-term coverage decrease (no waiting period), or it can be done separately. Deductible increases cannot be backdated.

- Coverage Decrease + Deductible Decrease: These must be done separately, as the rules are too restrictive to combine.

| Example: Coverage Decrease & Deductible Decrease |

A coverage decrease can only happen due to over-insurance, which is effective in the middle of the term (physical change) or at the inception (error). So today or a previous date.

A deductible decrease requires a 30-day wait, unless an exception is applied. So today or future date. |

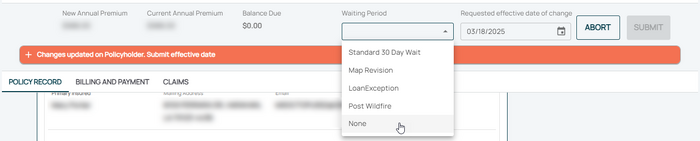

3. Choose Effective Date

Scroll to the top of the page to enter the effective date.

- Choose the Waiting Period based on the scenarios identified in Section 2.

- Calculate and enter the appropriate date.

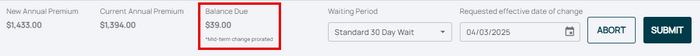

4. Review and Submit

Once the effective date is entered, the pro-rated premium amount will be displayed.

- The "Abort" button will exit the process without saving any details.

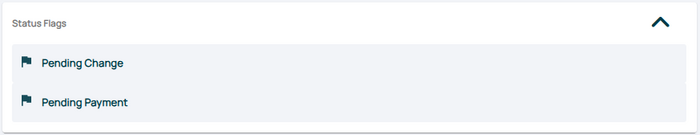

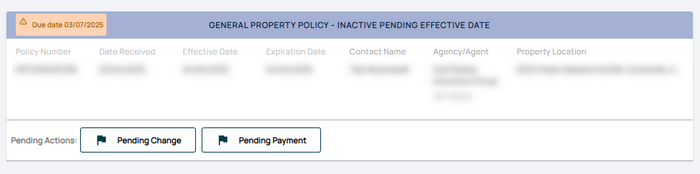

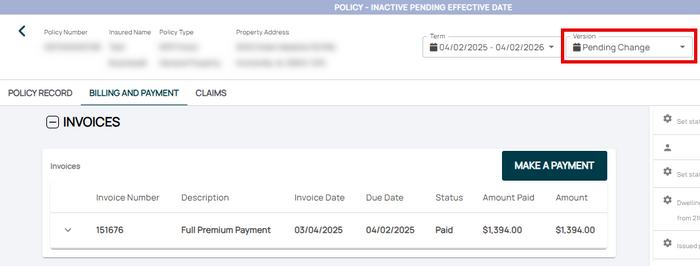

- The "Submit" button will create the policy change form and mark the policy with "Pending Change" and "Pending Payment" flags.

The system will not process the change immediately.

The Policy Record will show Pending Payment and Pending Change flags.

The policy in the Agency Workspace will show Pending Payment and Pending Change flags.

The agent can submit a payment on the Billing and Payment page.