|

|

| Line 246: |

Line 246: |

| |title = Building Description | | |title = Building Description |

| |content = | | |content = |

| {| | | |

| | {| class="wikitable" |

| ! Building Description !! Explanation | | ! Building Description !! Explanation |

| |- | | |- |

| Line 258: |

Line 259: |

| |Description field to specify unique dwelling characteristics. | | |Description field to specify unique dwelling characteristics. |

| |} | | |} |

| | |

| }} | | }} |

| <!--END OF COLLAPSIBLE --> | | <!--END OF COLLAPSIBLE --> |

Revision as of 11:44, 9 December 2024

|

This page may need to be edited based on suggestions or concerns. Read more in the Discussion page.

|

|

|

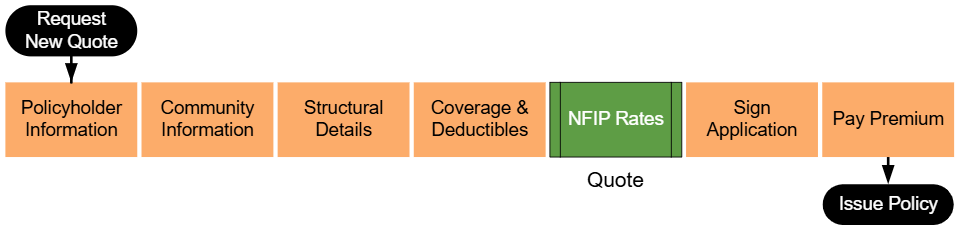

An agent must complete several steps to produce an NFIP application or obtain a quote. Equinox ensures that all required information is collected and validated before the application is submitted. This process is designed to reduce errors and enhance efficiency by guiding the agent through a series of steps that ensure compliance with NFIP guidelines. |

The workflow shown above begins by entering basic property details and continues through collecting additional information about the building, coverage options, and flood zone determinations. At the "NFIP Rates" step, highlighted in green, agents can generate a preliminary quote based on the details provided. This allows the agent to review potential costs before signing the application and collecting premium.

Information Icons Information Icons

|

Equinox has small information icons placed next to important sections or fields. When a user hovers over an icon, a small window provides extra details about that section. The messages from these icons can be found in the collapsible sections below.

|

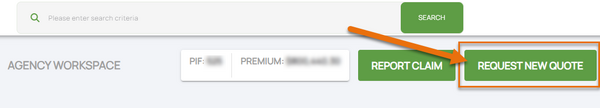

A. Request New Quote

To quote a property with the

NFIP, start in the

Agency Workspace.

Select the "Request New Quote" button near the top of the page.

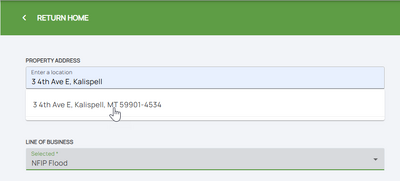

B. Property Address

Enter the property address. A verified address should show from the first dropdown window.

Choose "NFIP Flood" from the second drop down window.

Additional Property Address Details

Start in the Agency workspace by selecting "Request New Quote." Enter the property address, verify it on the map, and choose the line of business (e.g., NFIP Flood).

The address is verified using the

United States Postal Service.

C. Step 1: Basic Information

After assigning the property address, the policy effective date and insured details must be entered.

From this point forward, the right side of the page will show a page completion list with the quote/application progress.

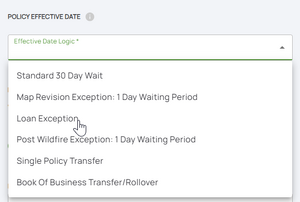

NFIP quotes are made in real time and rates are subject to change. All quotes must follow the NFIP waiting period rules assigned to new policies. For more information about each waiting period rule and how to calculate the application effective date, refer to the NFIP Effective Date Calculation.

NFIP Policy Effective Dates

An NFIP flood policy has a 30-day waiting period provided the premium and the application are received within 10 days of the agent sign date, unless one of the following exceptions apply:

- Map Revision: A 1-day waiting period may apply if there's been a map provision and the property was previously in a B, C, X, or D zone and is now in an A1 through A30 or V1 through V30 zone. The rezoning must have occurred no more than 13 months prior to today's date.

- Loan Exception: If this policy is being purchased to meet a lender requirement for a new purchase, loan closing, or the increasing, extending, or renewing of a loan, the policy will go into effect at the time of closing provided the application and premium are received in a timely manner.

- Post-Wildfire Exception: A 1-day waiting period applies if the insured property is privately owned and post-wildfire conditions on federal lands caused or worsened the flooding. The insured must have purchased the new policy or additional coverage on or before the fire containment date or during the 60 days following the containment date.

Additional Policyholder Details

The

policyholder should be identified as an individual or a legal entity, such as a trust. An additional co-insured (optional) can be added by clicking the slider option below the Insured Email Address.

D. Step 2: Third Party Data

The

Third Party Data step pre-populates essential property details from public records.

Agents should review all data for accuracy and manually input any missing or inaccurate information.

Date of Construction

The date of construction is the date that the original building permit was issued, provided the actual start of construction was within 180 days of the permit date. If the applicant does not know the date the building permit was issued, enter January 1 as the date and month and provide the actual year of construction. If the year of construction is the same as the initial FIRM date, the exact day and month will be required.

Number of Floors

Determine the building's number of floors based on the number of floors above the ground, excluding enclosures, crawl spaces which are both on grade or subgrade basements, and certain attics if only used for storage. For example:

- A building with a basement and one floor above ground is rated as having one floor.

- An elevated building with an enclosure either compliant or non-compliant and one additional floor above it is rated as having one floor.

Indicate the total number of floors in a multi-unit building, even if the policy will cover only an individual unit.

Square Footage

For a single-family home, a residential manufactured mobile home, a residential unit, or two- to four-family building, provide the total finished living area. Do not include:

- Garage area

- Basement or enclosure area

- Porches or decks

For other types of buildings, include the square footage of stairwells and elevator shafts but exclude basements or mezzanines. If all floors are the same size, calculate the floor area first, then compute the gross floor area by multiplying the ground floor area by the number of floors.

Building Replacement Cost Value

The building replacement cost is the cost to replace the building or unit, including the cost of the foundation for a building, not for a unit. The building replacement cost used for rating has no bearing on the amount of coverage the policyholder can select. If you do not agree with the replacement cost provided, update it accordingly. Supporting documentation requirements vary based on the type of building and its size, and the replacement cost must be validated every three years.

Substantial Improvement Date

A substantially improved building is a building that has undergone reconstruction, rehabilitation, addition, or other improvement, the cost of which equals or exceeds 50% (or a lower threshold if adopted and enforced by the community) of the market value of the building for the start of construction. This does not include:

- Improvements to correct code violations

- Alterations to historic buildings that preserve their designation

Construction Type

Select the construction type:

- Frame: First floor above ground level is constructed with wood or metal frame walls.

- Masonry: First floor above ground level is constructed with masonry, including brick or concrete block walls for the full story.

- Other: Includes mixed materials or specific exceptions like knee walls.

CBRA/OPA

The bottom of the page shows the community information and confirms CBRS and OPA details.

NFIP Participating Community Information: This section shows NFIP community classifications and program details such as regular, emergency, non-participating, or suspended status.

Coastal Barriers and Protected Areas (CBRS/OPA): Yes/No fields determine if the property falls within Coastal Barriers Resource System (CBRS) or Otherwise Protected Areas (OPA). These options impact eligibility and policy requirements.

E. Step 3: Property Information

The

Property Information step collects essential details about the property's residential use and the policy's interests.

Building Occupancy Type

NFIP divides Occupancy into one of two categories:

Detached Structures

Identify the number of detached structures at this location, even if they are not to be insured.

- Specify how many detached structures exist at the property address.

- The field defaults to "0" but can be adjusted using the arrow keys or by entering the number directly.

The dwelling form provides limited coverage for one detached garage that is not used for residential, commercial or agricultural purposes and at no more than 10 per cent of the limit of liability on the dwelling. If more than 10 per cent is needed, a separate policy will be required using the non-residential as the building type.

Primary Residence

Corresponds to the question "Do either you or your spouse reside in this building for greater than 50% of the year?"

Determines the appropriate HFIAA Surcharge

- Primary Residence: $25

- Non-primary Residence: $250

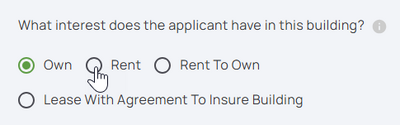

Applicant's Insurable Interest

The interest the applicant has in the building determines the type of coverage available to them.

A property owner may ensure both building and contents on the same policy.

A tenant may not purchase building coverage unless the tenant has the rent to own or a lease agreement requiring them to insure the building. In this case, the building owner must be listed as an additional insured on the policy and any contents that the tenant wants to insure must be written on a separate policy.

Additions & Extensions

A single flood insurance policy covers an entire structure, including additions and extensions to the building, unless the

additions or extensions qualify for a separate policy and a separate policy is purchased when this happens.

F. Step 4: Building Type

The

Building Type step allows agents to select the building's occupancy type and description. This step uses a button-based interface to simplify the process.

Single Family Dwelling

A single-family building, townhouse or row house that is residential or mixed-use with non-residential uses limited to less than 50% of the building's total floor area and not in a condominium ownership or not eligible for the Residential Condominium Building Association Policy form.

Two to Four Family Dwelling

A residential building including an apartment building containing 2 or 4 residential spaces and in which commercial uses are limited to less than 25% of the building's total floor area.

Manufactured/Mobile Home or Travel Trailer

A structure that is built on a permanent chassis, transported to its site in one or more sections and affixed to a permanent foundation.

Or a travel trailer without wheels that is built on a chassis and affixed to a permanent foundation and regulated under the community's floodplain management and building ordinances and laws.

Residential Unit

A single-family residential unit or a mixed unit with non-residential uses limited to less than 50% of the total floor area located within a residential or non-residential condominium building.

A residential or non-residential building not in a condominium form of ownership. For example, an apartment building, a cooperative building or townhouse row house in a condominium ownership if the insured is a unit as opposed to the entire building.

Building Description

G. Step 5: Foundation Type

The

Foundation Type step uses a series of radio buttons to help agents select the correct foundation type for the building. Clicking on a radio button displays images of foundation types, which can be clicked to finalize the selection.

Agents must also answer a single question about the number of elevators in the building.

H. Step 6: Elevation Certificate Information

The Elevation Certificate Information step requires agents to manually enter key details from an Elevation Certificate (EC).

I. Step 7: Qualifying Questions

The

Qualifying Questions step assesses the

building's eligibility for coverage with the National Flood Insurance Program (NFIP). Agents must confirm that the property meets specific structural and locational criteria, such as the building's structural makeup and location relative to bodies of water.

J. Step 8: Coverage, Deductibles & Discounts

The

Coverage, Deductibles & Discounts step allows agents to select policy coverage amounts, choose deductible options, and confirm discount eligibility for the applicant.

Discount Eligibility

Agents must answer questions to determine eligibility for specific NFIP discounts, such as:

- Prior policy status, including lapses for Newly Mapped or Pre-FIRM discounts.

- The elevation of essential equipment, such as air conditioners, water heaters, and elevator machinery, above the first-floor elevation.

K. Step 9: Rates

The

Rates step provides a summary of the total annual premium, itemized by coverage type and discounts, and collects final details needed to complete the application.

Agents must:

- Review the itemized premium amounts and verify accuracy.

- Enter any of the additional details:

- Insured mailing address

- Additional insureds

- Mortgagee information

- Agent of record

- Provide any additional relevant details in the text box for supplementary information.

- Electronically sign the document.

Next Steps

Once all steps are finished, the NFIP Application is complete.

The next step for Equinox to issue the policy would be to submit premium payment.