NFIP Effective Date Calculation

Effective dates are a critical aspect of insurance policies, influencing nearly every client transaction and interaction. Understanding how effective dates are calculated—and the potential impact of typographical errors or miscalculations—is essential.

While the Equinox system automates most effective date calculations, it’s important to remain vigilant in ensuring accuracy, which requires a thorough understanding of the NFIP rules about effective date calculation.

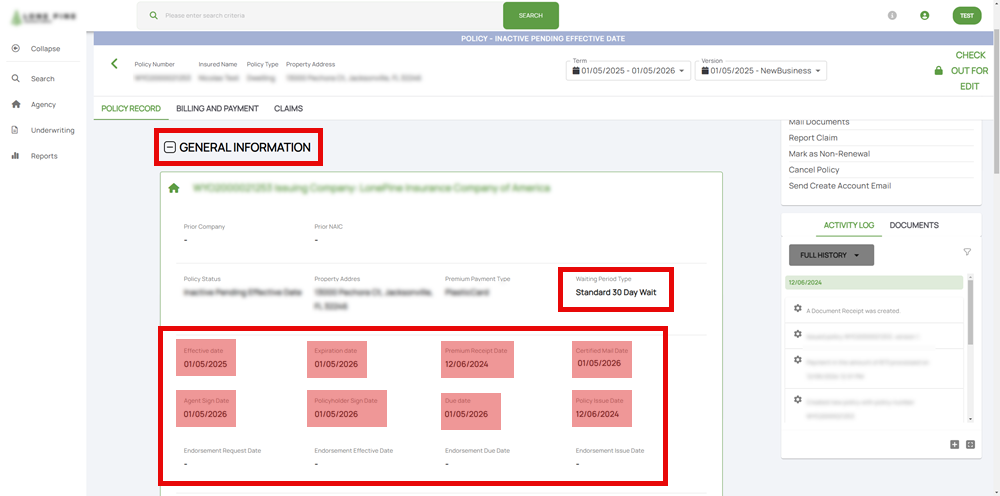

| Policy Record |

In Equinox, information about the policy Effective Date is found in the General Information section.

|

30 Day Wait

In general, new flood insurance policies (and changes to an existing policy that add or increase coverage) become effective following a 30-day waiting period (agent signature date plus 29 days)

- Calculation of the 30-day waiting period begins the date the application or change request is signed by the agent

- The application or change request and the applicable premium must be received by the company within 10 days of the agent’s signature date (signature date plus 9 days).

- Policy and change effective dates will automatically be recalculated for those that do not meet the 10-day requirement.

If the application (or policy change request) and the applicable premium are not received within 10 days of the agent’s sign date, the policy will become effective 10 days from the date the application and premium are received by the company.

To avoid effective date changes, agents are encouraged to submit applications and premiums electronically using functionality provided as part of the new business application process or the change process to increase coverage.

| Why does the NFIP have a waiting period before a policy goes into effect? |

This waiting period is to prevent shoppers from buying flood insurance right before a storm or hurricane. If an insured property is flooded during the policy's waiting period, the insured won't have any coverage.

|

Map Revision (1-Day Waiting Period)

A map revision, moving a property from a non-special flood hazard area to a special flood hazard area, allows a policy to go into effect 1 day after the agent’s sign date

- The application must be dated within 13 months of the map revision

- The application and premium must be received within 10 days of the agent’s sign date

- This rule applies for all buildings including condominium associations.

If the application or change request form, along with the applicable premium are not received within 10 days of the agent’s sign date, the policy or coverage change will become effective 1 day after the date the application and premiums are received by the company.

Loan Exception

A policy or increase in coverage may go into effect at the time of loan closing provided:

- The initial purchase of new, additional, or increased flood insurance coverage is in connection with the making, increasing, extending or renewal of a loan

- The loan is secured by the insured property

- The application is signed on or before the closing date

- The application or change request and the applicable premium are received within the specified timelines

If the lender, title company or settlement attorney pays the premium, the insurer must receive the application or change form within 30 calendar days of the closing date (closing date plus 29 days)

When an agent submits an agency check, it must be accompanied by settlement paperwork or a photocopy of the original check from the lender, title company, or settlement attorney to be eligible for the waiting period exception.

If the policyholder or another party pays the premium the application or change request and the applicable premium must be received by the company within 10 days of the closing date (closing date plus 9 days).

Policy and change effective dates will automatically be recalculated for those that do not meet these requirements based on the closing date and the insurer’s receipt date.

Effective Date Recalculation

The date the waiting period begins varies based on:

- The date of the Application Form (or endorsement request);

- The method of sending the Application Form or (endorsement request) and payment;

- The date the insurer receives the Application Form (or endorsement request) and full amount due (including applicable premiums, surcharges, and fees).

It is critical that the signed application and full premium are received by the insurer within 10 days of the agent’s signature date to avoid recalculation of the waiting period based on the application and premium receipt date by the company (unless the loan closing requirements are met or certified mail is used).

| Certified Mail |

For the purposes of determining a waiting period start date, “certified mail” includes certified mail sent through the U.S. Postal Service or a reputable third-party delivery service that provides proof of the actual mailing date and delivery date to the insurer.

|

Insurers must follow the applicable waiting period and effective date rules for all policies, including policies issued in conjunction with a community’s initial entry into the Regular Program or conversion from the Emergency Program to the Regular Program.